“Riding the Yield Curve” is the topic covered in the CFA Fixed Income, Module 1, Section 3, “Active Bond Portfolio Management”. In this blog post, I will simulate the approach discussed in the CFA curriculum with the support of the QuantLib library.

“Riding the Yield Curve”, also known as “Rolling Down the Yield Curve”, is a popular yield curve trading strategy. It involves going long on bonds with maturities longer than the investment horizon and shorting bonds after the investment horizon, rather than holding bonds with a maturity that matches the investment horizon. This strategy relies on two key assumptions:

- The yield curve is upward sloping

- The yield curve remains static over an investment horizon

In a market condition where the yield curve slopes upward and remains relatively static over an investment horizon, as a bond approaches its maturity, it is progressively valued at lower yields and higher prices. Consequently, the bond’s price increases as it ‘rolls down’ the yield curve, which results in capital gains for the investor holding a bond with longer maturity.

The CFA curriculum breaks the total return of a fixed-rate bond into three components: coupons, interest from coupon reinvestment, and capital gains from selling the bond prior to maturity. The first two components represent the ‘Carry‘ return of the bond, which compensates the investor for the time value of money, while the last component is the ‘Roll-Down‘ return, which results from the interest rate fluctuations in the bond’s price.

In the following assumed example, there two trading options for a 3 years investment horizon:

- Long a 3 year fixed-rate bond and hold to maturity

- Long a 10 years fixed-rate Bond and short after 3 years

Let’s take a look at the result first before looking into the code details.

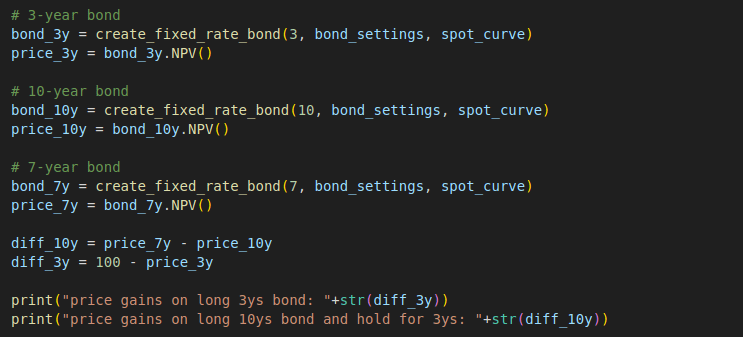

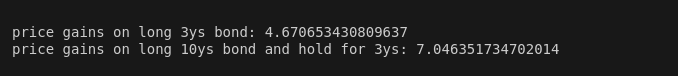

We created three QuantLib bond instances with the maturity of year 3, year 10 and year 7, and calling the NPV method to return the evaluated price of each. As the investment lengths for the two trading options are same, i.e. 3 years, the carry returns are some for them. Therefore, we only need to compare the price differences.

The result shows that the gains from price movement of 3 year hold-to-maturity bond is 4.67 and the gains from the curve riding option is 7.05.

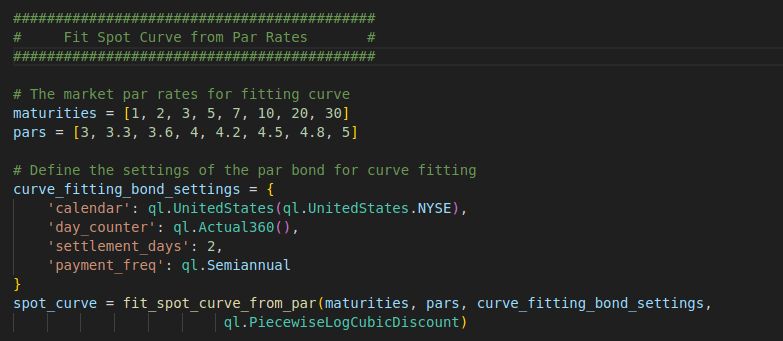

Now let’s look into the code. First, we need fit the spot curve from the market rates. Here, we can reuse the fit_spot_curve_from_par function we created in the previous blog post. The full code of the function can be found at the bottom of this page.

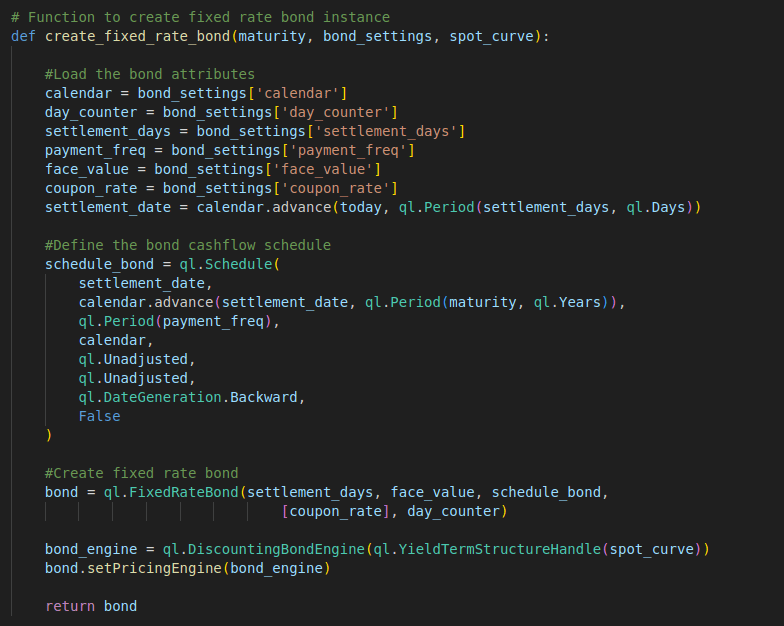

The create_fixed_rate_bond function create a QuantLib FixedRateBond instance. An DiscountingBondEngine instance is created that uses the yield curve we just fit earlier. With the FixedRateBond instance, we can trigger the pricing with its NPV or cleanPrice methods.

Full Code – QuantLib

import QuantLib as ql

# Function to fit spot curve from a par curve using QuantLib

def fit_spot_curve_from_par(maturities, pars, bond_settings,

fit_method, fit_model=None):

# Fetch the settings of the bond instruments used for curve fitting

calendar = bond_settings['calendar']

day_counter = bond_settings['day_counter']

settlement_days = bond_settings['settlement_days']

payment_freq = bond_settings['payment_freq']

settlement_date = calendar.advance(today,

ql.Period(settlement_days, ql.Days))

# Loop through the provided maturities and create bond helpers for each

rate_helpers = []

for i in range(len(maturities)):

# Calculate maturity date by advancing settlement

# date by the maturity period

maturity_date = calendar.advance(settlement_date,

ql.Period(maturities[i], ql.Years))

#Define the bond cashflow schedule

schedule = ql.Schedule(

settlement_date,

maturity_date,

ql.Period(payment_freq),

calendar,

ql.ModifiedFollowing,

ql.ModifiedFollowing,

ql.DateGeneration.Backward,

False)

#Create the fixed rate bond helper for the maturity date

helper = ql.FixedRateBondHelper(

ql.QuoteHandle(ql.SimpleQuote(100)),

settlement_days,

100.0,

schedule,

[pars[i]/100],

day_counter

)

rate_helpers.append(helper)

if fit_model is None:

# fit the curve using the fit method specified through the fit_method parameter

curve = fit_method(today, rate_helpers, day_counter)

else:

# The fit_model is only provided when using FittedBondDiscountCurve

curve = fit_method(settlement_days, calendar, rate_helpers, day_counter, fit_model)

return curve

# Function to create fixed rate bond instance

def create_fixed_rate_bond(maturity, bond_settings, spot_curve):

#Load the bond attributes

calendar = bond_settings['calendar']

day_counter = bond_settings['day_counter']

settlement_days = bond_settings['settlement_days']

payment_freq = bond_settings['payment_freq']

face_value = bond_settings['face_value']

coupon_rate = bond_settings['coupon_rate']

settlement_date = calendar.advance(today, ql.Period(settlement_days, ql.Days))

#Define the bond cashflow schedule

schedule_bond = ql.Schedule(

settlement_date,

calendar.advance(settlement_date, ql.Period(maturity, ql.Years)),

ql.Period(payment_freq),

calendar,

ql.Unadjusted,

ql.Unadjusted,

ql.DateGeneration.Backward,

False

)

#Create fixed rate bond

bond = ql.FixedRateBond(settlement_days, face_value, schedule_bond,

[coupon_rate], day_counter)

bond_engine = ql.DiscountingBondEngine(ql.YieldTermStructureHandle(spot_curve))

bond.setPricingEngine(bond_engine)

return bond

# Set evaluation date for QuantLib

today = ql.Date(23, 12, 2024)

ql.Settings.instance().evaluationDate = today

###########################################

# Fit Spot Curve from Par Rates #

###########################################

# The market par rates for fitting curve

maturities = [1, 2, 3, 5, 7, 10, 20, 30]

pars = [3, 3.3, 3.6, 4, 4.2, 4.5, 4.8, 5]

# Define the settings of the par bond for curve fitting

curve_fitting_bond_settings = {

'calendar': ql.UnitedStates(ql.UnitedStates.NYSE),

'day_counter': ql.Actual360(),

'settlement_days': 2,

'payment_freq': ql.Semiannual

}

spot_curve = fit_spot_curve_from_par(maturities, pars, curve_fitting_bond_settings,

ql.PiecewiseLogCubicDiscount)

###########################################

# Price Fixed-Rate Bonds #

###########################################

# Define the settings of the fixed bonds for riding the yield curve

bond_settings = {

'calendar': ql.UnitedStates(ql.UnitedStates.NYSE),

'day_counter': ql.Actual360(),

'settlement_days': 2,

'payment_freq': ql.Annual,

'coupon_rate': 0.02,

'face_value': 100

}

# 3-year bond

bond_3y = create_fixed_rate_bond(3, bond_settings, spot_curve)

price_3y = bond_3y.NPV()

# 10-year bond

bond_10y = create_fixed_rate_bond(10, bond_settings, spot_curve)

price_10y = bond_10y.NPV()

# 7-year bond

bond_7y = create_fixed_rate_bond(7, bond_settings, spot_curve)

price_7y = bond_7y.NPV()

diff_10y = price_7y - price_10y

diff_3y = 100 - price_3y

print("price gains on long 3ys bond: "+str(diff_3y))

print("price gains on long 10ys bond and hold for 3ys: "+str(diff_10y))