Performance attribution is discussed in the CFA Portfolio Management curriculum, specifically in Module 2, Section 2: "Active Management and Value Added". Performance attribution is a process used to decompose the "value added," i.e., the excess return relative to a benchmark, into different sources. In the CFA curriculum, a simplified Brinson model is presented, which discusses the basic calculations of … Continue reading Coding towards CFA (36) – Performance Attribution with Brinson Model in DolphinDB and Python

Tag: DolphinDB

Coding towards CFA (16) – Dynamic Delta Hedging with DolphinDB

Delta hedging is an options trading strategy used to maintain a delta neutral position by ensuring that the overall delta of a portfolio is zero, so that the price fluctuations of the underlying asset do not significantly impact the position’s value. Dynamic delta hedging involves continuously adjusting the hedging position to account for changes in … Continue reading Coding towards CFA (16) – Dynamic Delta Hedging with DolphinDB

Coding towards CFA (15) – Real-Time Option Greeks Calculation with DolphinDB

In the previous blog post, we explored option Greeks calculations using the BSM model. In this post, I’ll have some coding fun by implementing real-time Greeks calculations with the formulas from the last post, but this time using the DolphinDB stream processing framework. Here, I plan to mimic a portfolio consisting of option contracts with … Continue reading Coding towards CFA (15) – Real-Time Option Greeks Calculation with DolphinDB

Coding towards CFA (5) – Currency Swap Pricing and Valuation

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. A currency swap is a financial agreement where two … Continue reading Coding towards CFA (5) – Currency Swap Pricing and Valuation

Coding towards CFA (4) – Interest Rate Swap Pricing and Valuation

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. An Interest Rate Swap (IRS) is a financial derivative … Continue reading Coding towards CFA (4) – Interest Rate Swap Pricing and Valuation

Coding towards CFA (3) – Bond Futures Pricing

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. Bond futures are financial contracts that obligate the buyer … Continue reading Coding towards CFA (3) – Bond Futures Pricing

Coding towards CFA (2) – FRA Pricing & Valuation

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. This blog post focuses on pricing and valuing forward … Continue reading Coding towards CFA (2) – FRA Pricing & Valuation

Coding towards CFA (1) – Forward Contract Pricing & Valuation

This blog post focuses on pricing and valuing forward contracts for underlying assets with or without carry costs and benefits, as well as pricing stock index forward contracts. In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic … Continue reading Coding towards CFA (1) – Forward Contract Pricing & Valuation

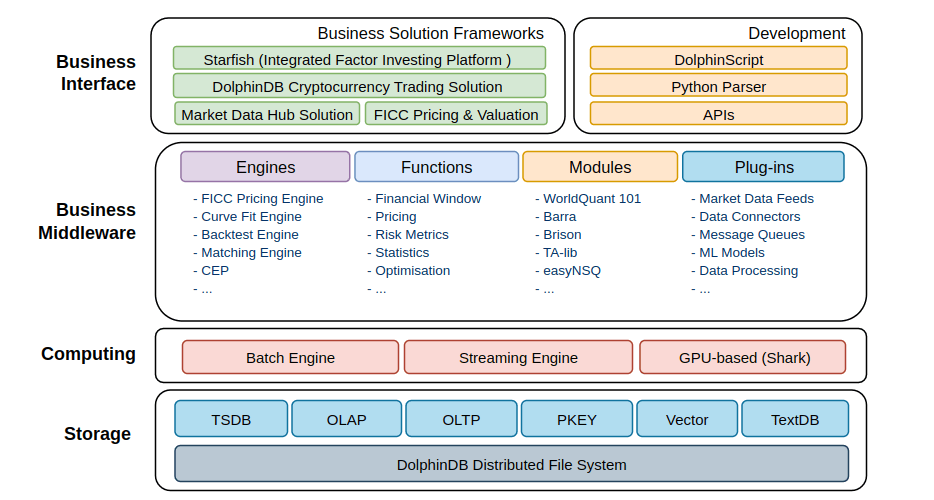

DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database When I chat about DolphinDB with someone, it’s common … Continue reading DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database

Cost Effective DolphinDB – Worth the Money

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database This is the fourth post in my series where … Continue reading Cost Effective DolphinDB – Worth the Money

You must be logged in to post a comment.