In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. An Interest Rate Swap (IRS) is a financial derivative … Continue reading Coding towards CFA (4) – Interest Rate Swap Pricing and Valuation

Coding towards CFA (3) – Bond Futures Pricing

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. Bond futures are financial contracts that obligate the buyer … Continue reading Coding towards CFA (3) – Bond Futures Pricing

Coding towards CFA (2) – FRA Pricing & Valuation

In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic will begin with a brief explanation of the formulas or algorithms, followed by their implementations in Python and DolphinDB. This blog post focuses on pricing and valuing forward … Continue reading Coding towards CFA (2) – FRA Pricing & Valuation

Coding towards CFA (1) – Forward Contract Pricing & Valuation

This blog post focuses on pricing and valuing forward contracts for underlying assets with or without carry costs and benefits, as well as pricing stock index forward contracts. In this blog series, I will aim to code the formulas and model algorithms covered in the CFA Level 2 program using Python and DolphinDB. Each topic … Continue reading Coding towards CFA (1) – Forward Contract Pricing & Valuation

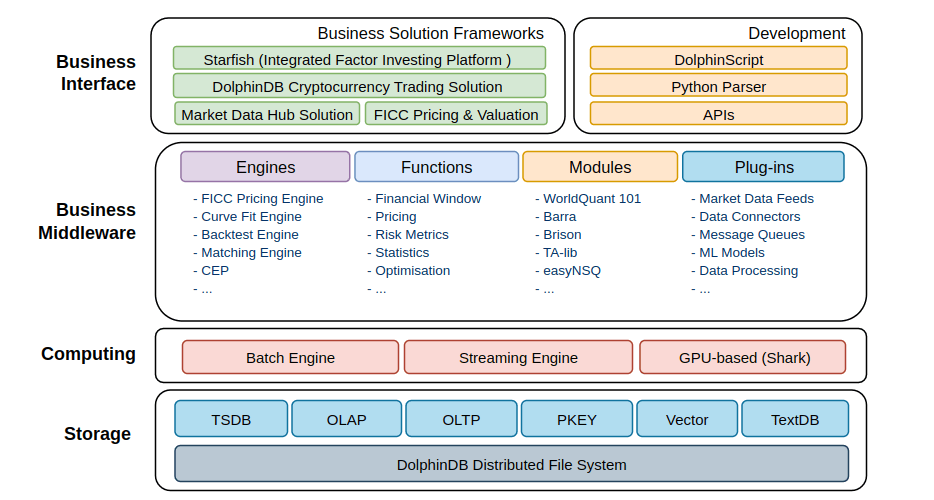

DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database When I chat about DolphinDB with someone, it’s common … Continue reading DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database

Cost Effective DolphinDB – Worth the Money

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database This is the fourth post in my series where … Continue reading Cost Effective DolphinDB – Worth the Money

Robust DolphinDB – How does DolphinDB Achieve Scalability, Reliability, Resilience, Consistency, and Monitorability

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database As a high-performance database built for business-critical financial applications … Continue reading Robust DolphinDB – How does DolphinDB Achieve Scalability, Reliability, Resilience, Consistency, and Monitorability

Speedy DolphinDB – Why is DolphinDB So Fast?

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database In my last blog post, I showcased a cross-exchange … Continue reading Speedy DolphinDB – Why is DolphinDB So Fast?

Friendly DolphinDB – Cross-Exchange Arbitraging Case

What makes me buy into DolphinDB: Friendly DolphinDB – Cross-Exchange Arbitraging Case Speedy DolphinDB – Why is DolphinDB so fast? Robust DolphinDB – Reliable, Scalable, Resilient, Consistent, and Monitorable Cost Effective DolphinDB – Worth the Money DolphinDB – An Integrated Financial Data Platform, Not Just a Time-Series Database I reckon there is no doubt that kdb+ has … Continue reading Friendly DolphinDB – Cross-Exchange Arbitraging Case

Buy-Side Financial Data Engineering (3) – Market Data Management

Buy-Side Financial Data Engineering (1) - Overview Buy-Side Financial Data Engineering (2) - Financial Instruments Buy-Side Financial Data Engineering (3) - Market Data Management As a data guy, two thoughts immediately come to my mind when I hear the term "Finance Market Data", 1) They are bloody expensive; 2) What a chore to handle all … Continue reading Buy-Side Financial Data Engineering (3) – Market Data Management

You must be logged in to post a comment.